Iowa Property Taxes

Property Tax | Iowa Tax And Tags

one of the county treasurer's responsibilities is to collect taxes for real estate property, manufactured homes, utilities, bushels of grain, monies and credits, buildings on leased land, and city and county special assessments, including delinquent sewer rental and solid waste rates and charges for all tax levying and tax certifying entities of …

https://www.iowataxandtags.org/property-tax/

Iowa Property Tax Overview | Iowa Department of Revenue

How are property taxes determined? 1. The value of property is established. The assessor (or the Iowa Department of Revenue) estimates the value of each property. This is called the "assessed value." The assessed value is to be at actual or market value for most property taxes. 2. The assessments of all taxable properties are added together.

https://tax.iowa.gov/iowa-property-tax-overview

Property Taxes | Iowa Department Of Revenue

Iowa Property Tax Credit Claim 54-001. Read more about Iowa Property Tax Credit Claim 54-001; Print; Pagination. Page 1 ; Next page ...

https://tax.iowa.gov/tax-type/property-taxes

Property Tax | Iowa Department Of Revenue

Learn About Property Tax; Learn About Sales & Use Tax; File a W-2 or 1099; Request Tax Guidance; Tax Forms. Tax Forms Index; IA 1040 Instructions; Resources. Law & Policy Information; Reports & Resources; Tax Credits & Exemptions; Education; Tax Guidance; Tax Research Library; Iowa Tax Reform; Adopted and Filed Rules; Need Help? Common ...

https://tax.iowa.gov/division/property-tax

Iowa County Treasurers

Property Tax Information: Property taxes may be paid in semi-annual installments due September and March. The Amount Payable Online represents all taxes that are payable online for each parcel listed in either the first (September) or second (March) payment period. Full or partial payments of current and delinquent taxes will be accepted at any ...

https://www.iowatreasurers.org/Iowa Property Taxes By County - 2022 - Tax-Rates.org

The median property tax in Iowa is $1,569.00 per year for a home worth the median value of $122,000.00. Counties in Iowa collect an average of 1.29% of a property's assesed fair market value as property tax per year. Iowa is ranked number twenty eight out of the fifty states, in order of the average amount of property taxes collected.

https://www.tax-rates.org/iowa/property-tax

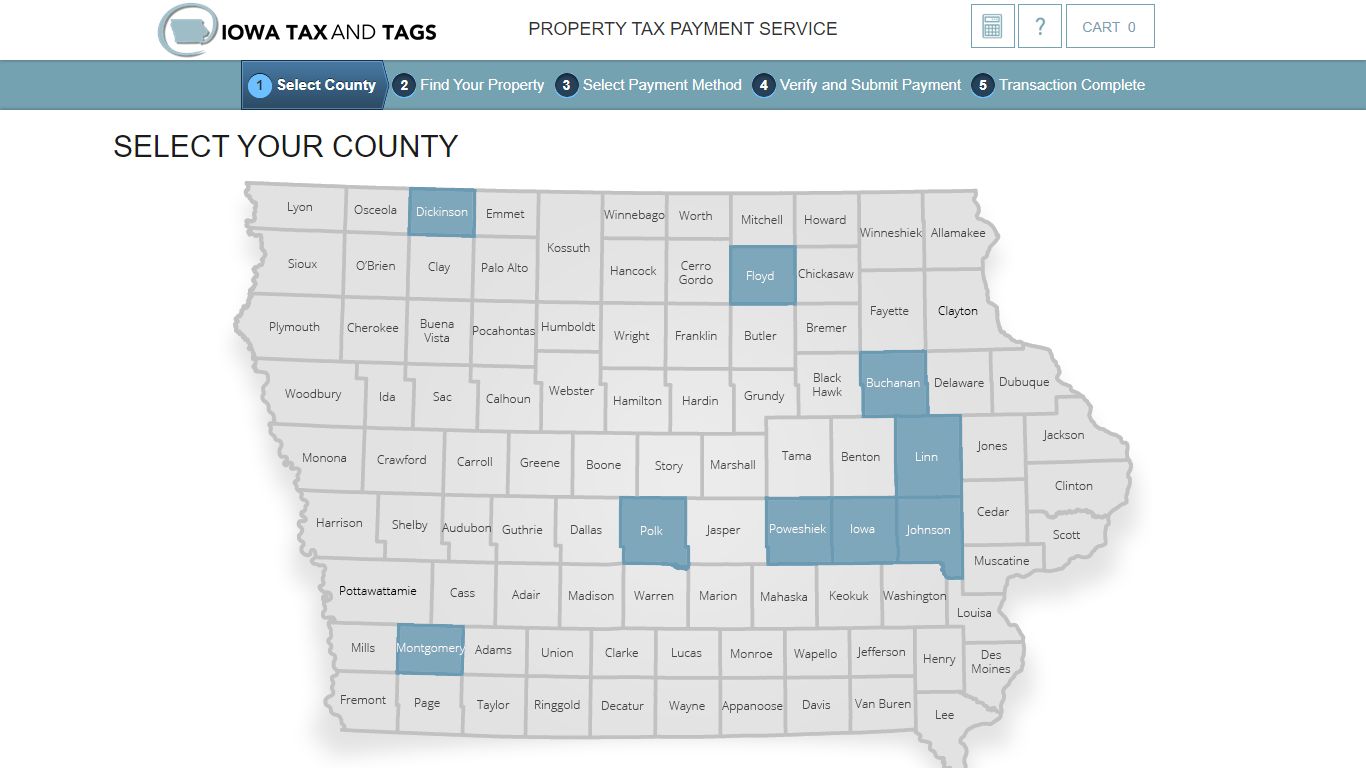

Pay Property Taxes - Select Your County - Iowa Tax And Tags

Property Tax Payment Service. CART 0 . 1 Select County; 2 Find Your Property; 3 Select Payment Method; 4 Verify and Submit ... Montgomery. Polk. Poweshiek. Other... Or, choose your county from the list below: Buchanan. Dickinson. Floyd. Iowa. Johnson. Linn. Montgomery. Polk. Poweshiek. Other... Step 1 of 5 Step 1 of 5 Pay Vehicle Taxes

https://pay.iowataxandtags.org/taxes

State of Iowa Taxes | Iowa Department of Revenue

The Department has submitted a proposed rule to the Iowa Legislature (Sales, Use, and Excise Taxes) and also adopted and filed the an emergency rule (Permits, Filing Returns, and Payments of Sales and Use Taxes) to the Iowa Legislature, effective July 1, 2022, both available for public comment through August 11, 2022.

https://tax.iowa.gov/

Property Tax - Polk County Iowa

7 a.m.-5 p.m. Mon-Fri. | Open 9 a.m.-5 p.m. on the third Thursday of every month. Hours may vary for different types of transactions. Please see contact information for the Vehicle and Property Tax divisions for more details on their hours. Vehicle 515-286-3030 Property Tax 515-286-3060 Fax 515-323-5202 [email protected]

https://www.polkcountyiowa.gov/treasurer/property-tax/

Property Search - Iowa Treasurers Site

Property Tax Information: Property taxes may be paid in semi-annual installments due September and March. The Amount Payable Online represents all taxes that are payable online for each parcel listed in either the first (September) or second (March) payment period. Full or partial payments of current and delinquent taxes will be accepted at any ...

https://www.iowatreasurers.org/parceldetail.phpProperty Taxes - Treasurer - Cedar County, IA

Property taxes may be paid in full in September each year or split into two installments: The first half is due September 1 and becomes delinquent October 1; The second half is due March 1 of the following year and becomes delinquent April 1; Delinquent interest accrues at the rate of 1.5% per month, rounded to the nearest dollar with a minimum ...

https://cedarcounty.iowa.gov/treasurer/property_taxes/

Property Taxes - Iowa

The Tax Division is responsible for collecting taxes for real estate property, mobile homes, utilities, computer equipment, industrial machinery, bushels of grain, monies and credits, buildings on leased land, and city and county special assessments, including delinquent sewer rental and solid waste rates and charges for all tax levying and tax certifying entities of the county.

https://clarkecounty.iowa.gov/real-estate/property-taxes/